By Pewu Y. Sumo

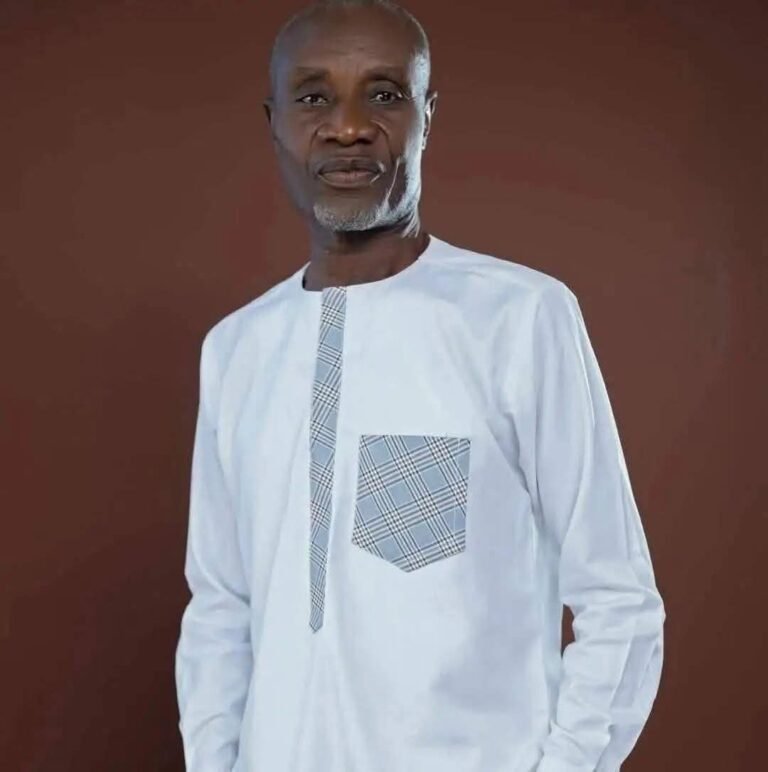

Monrovia — The Commissioner General of the Liberia Revenue Authority (LRA), James Dorbor Jallah, is calling for increased support for the entity to strengthen its revenue collection capacity.

The appeal comes as the LRA announced it has already surpassed its 2025 revenue target by $13 million. Speaking on Monday, December 29, CG Jallah emphasized that the authority has the potential to reach an ambitious $2 billion target in the near future through strategic expansion rather than increased taxation.

Broadening the Tax Base

CG Jallah clarified that the LRA aims to hit these milestones without placing an extra burden on ordinary taxpayers. Instead, the focus will shift toward untapped sectors, specifically real estate.

“Our intention is to achieve this new milestone without necessarily increasing the tax burden on individuals,” Jallah stated. He noted that significant revenue remains uncollected from property owners. “Those real estate owners who are not paying real estate taxes—we are going after them.”

He also reminded the public of existing legal obligations regarding rental income. “Those of you who are paying rent: the law requires you to withhold 10% of that rent and remit it to the LRA,” Jallah clarified. He added that increased public awareness is essential to meeting these national goals.

Leveraging Technology for Transparency

A key pillar of Jallah’s strategy is the modernization of collection systems. He highlighted the implementation of electronic invoicing as a transformative innovation for Liberian commerce.

Under this system, businesses utilize electronic physical devices or integrated software. “The system allows sellers to enter sale details which flow directly from the seller’s ERP (Enterprise Resource Planning) to the buyer’s system, creating a real-time record of the transaction,” Jallah explained. This allows customers to verify transactions via the LRA app on their mobile devices.

Overcoming the “Self-Declaration” Hurdle

Despite recent successes, Jallah identified the current “self-declaration” system as the LRA’s greatest challenge.

Under the existing framework, businesses record their own sales and report them to the LRA at the end of a filing period. Jallah noted that this method is highly susceptible to manipulation, alleging that it enables some businesses to under-declare their earnings to avoid paying their fair share. Moving toward real-time, tech-driven monitoring is intended to close these loopholes and ensure every dollar is accounted for.