Monrovia — The Liberia Revenue Authority (LRA), in partnership with the OECD’s Tax Inspectors Without Borders – Criminal Investigation (TIWB-CI) program and tax experts from Sweden and Kenya, has concluded the second Joint Tax Crime Investigation Mission in Liberia marking another major step toward strengthening the country’s fight against tax evasion and financial crime.

The weeklong mission brought together investigators and technical specialists from the LRA, the Financial Intelligence Division (FID), the Swedish Tax Agency (STA), the Kenya Revenue Authority (KRA), as well as representatives from the Liberia National Police (LNP), the Ministry of Justice (MoJ), and the Liberia Anti-Corruption Commission (LACC).

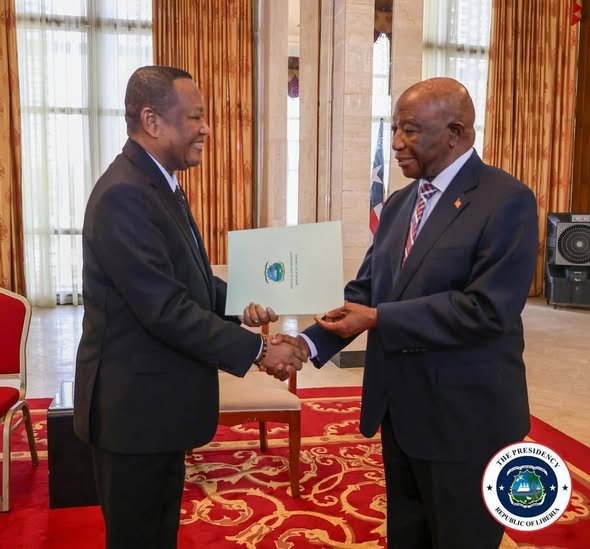

Commissioner General James Dorbor Jallah said the mission focused on reviewing selected tax and financial crime cases using real-time evidence to determine their suitability for deeper investigation or prosecution.

He noted that the engagement builds on the first joint mission, which set a detailed work plan and priority areas, while the second mission assessed progress and reinforced ongoing reforms.

A recent TIWB-CI gap analysis identified several institutional challenges affecting effective tax crime enforcement in Liberia, including inadequate intelligence sharing, fragmented information systems, and limited investigative capacity across relevant institutions.

In response, the LRA is taking key steps to strengthen the country’s tax crime framework. These include drafting amendments to improve tax crime legislation, establishing a Tax Crime Working Group, and expanding collaboration with national law enforcement bodies.

The reforms are also feeding into the development of an integrated national tax crime strategy, expected to be coordinated through a high-level Inter-Ministerial Committee.

Commissioner General James Dorbor Jallah stressed that tackling tax crime is vital to ensuring fairness, building public trust, and meeting Liberia’s Domestic Resource Mobilization (DRM) goals.

He called for sustained political support, stronger inter-agency cooperation, and a data-driven approach to protect the nation’s revenue base and advance national development.

The successful conclusion of the second TIWB-CI mission marks a significant advancement in Liberia’s efforts to combat tax crime and strengthen the integrity of its revenue administration systems.